Starting v2.07B SBER SMI has built-in support to analyze opportunity type i.e. whether it is a good opportunity or a poor opportunity.

How to use the information?

Opportunity information appears when the price crosses below or above the trend line of the pullback range. This information does not impact the stop-loss or other trading rules.

- Good opportunity – Price action suggests that this pullback is expected to result in a good trade which might gain momentum too.

- Poor opportunity – Price action suggests that this pullback is expected to result in either slow or range-bound or quick reversal (i.e. trap).

Breakouts with good opportunity at the time of closing of the day can result in good sudden volatile movement the next day at the opening, provided opening is not against SL point (this is not BTST or STBT recommendation).

Normally it is recommended to keep position either hedged or with low exposure or the trader can avoid trading when the opportunity showed is poor. Good opportunity trades can be taken as usual with no change in rules of SBER SMI

How to add it to the chart?

Remember that nothing can beat human analysis. There may be multiple factors that may influence the opportunity. Thus, we recommend the trader to use diligence while depending on opportunity type information presented in SBER SMI.

SBER SMI calculates the type of opportunity type based on recent price action and may recommend it as good or poor.

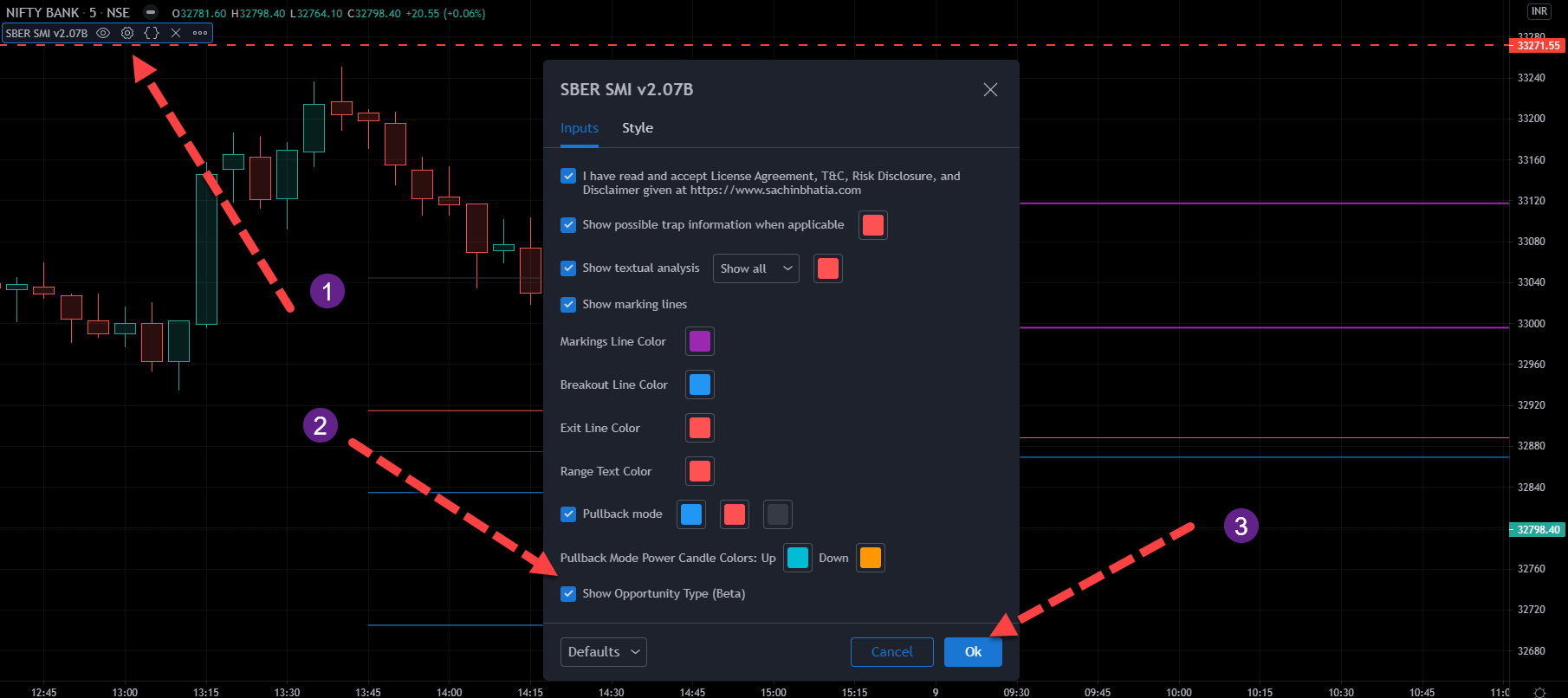

How to turn on or off the opportunity type information?

Go to indicator settings and locate the option to turn on or off option for “Show Opportunity”, as shown in step 1 to 3 in the image below